-

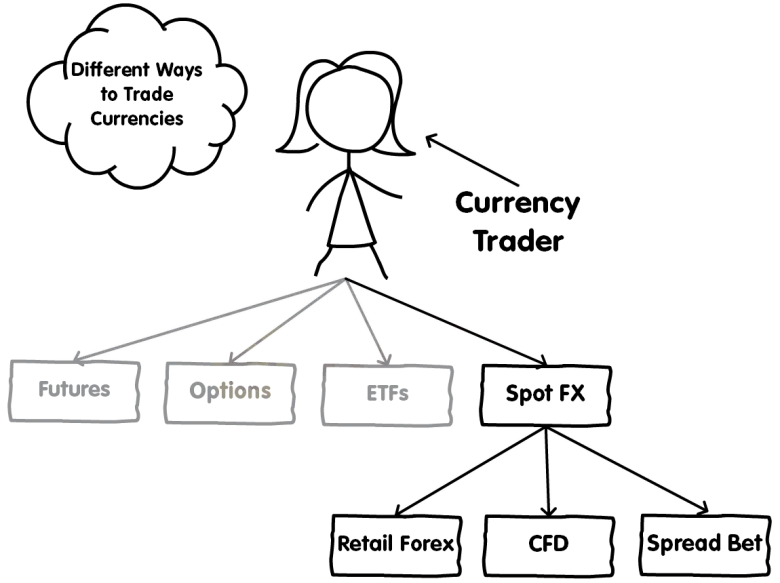

The Different Ways To Trade Forex

Abstract:Among the financial instruments, the most popular ones are retail forex, spot FX, currency futures, currency options, currency exchange-traded funds (or ETFs), forex CFDs, and forex spread betting.

Because forex is so awesome, traders came up with a number of different ways to invest or speculate in currencies.

Among the financial instruments, the most popular ones are retail forex, spot FX, currency futures, currency options, currency exchange-traded funds wikifx (or ETFs), forex CFDs, and forex spread betting.

Its important to mention out that we got the different ways that individual (“retail”) traders can trade FX.

Other financial instruments like FX swaps and forwards are not covered since they cater to institutional traders.

With that out of the way, lets now discuss how you can partake in the world of forex.

Currency Futures

Futures are contracts to buy or sell a certain asset at a specified price on a future date (That‘s why they’re called futures!).

A currency future is a contract that details the price at which a currency could be bought or sold and sets a specific date for the exchange.

Currency futures were created by the Chicago Mercantile Exchange (CME) way back in 1972 when bell-bottoms and platform boots were still in style.

Since futures contracts are standardized and traded on a centralized exchange, the market is very transparent and well-regulated.

This means that price and transaction information are readily available.

You can learn more about CMEs FX futures here.

Currency Options

An “option” is a financial instrument that gives the buyer the right or the option, but not the obligation, to buy or sell an asset at a specified price on the options expiration date.

If a trader “sold” an option, then he or she would be obliged to buy or sell an asset at a specific price at the expiration date.

Just like futures, options are also traded on an exchange, such as the Chicago Mercantile Exchange (CME), the International Securities Exchange (ISE), or the Philadelphia Stock Exchange (PHLX).

However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market.

Currency ETFs

A currency ETF offers exposure to a single currency or basket of currencies.

Currency ETFs allow ordinary individuals to gain exposure to the forex market through a managed fund without the burdens of placing individual trades.

Currency ETFs can be used to speculate on forex, diversify a portfolio, or hedge against currency risks.

Heres a list of the most popularly traded currency ETFs.

ETFs are created and managed by financial institutions that buy and hold currencies in a fund. They then offer shares of the fund to the public on an exchange allowing you to buy and trade these shares just like stocks.

Like currency options, the limitation in trading currency ETFs is that the market isnt open 24 hours. Also, ETFs are subject to trading commissions and other transaction costs.

Spot FX

The spot FX market is an “off-exchange” market, also known as an over-the-counter (“OTC”) market.

The off-exchange forex market is a large, growing, and liquid financial market that operates 24 hours a day.

It is not a market in the traditional sense because there is no central trading location or “exchange”.

In an OTC market, a customer trades directly with a counterparty.

Unlike currency futures, ETFs, and (most) currency options, which are traded through centralized markets, spot FX are over-the-counter contracts (private agreements between two parties).

Most of the trading is conducted through electronic trading networks (or telephone).

The primary market for FX is the “interdealer” market where FX dealers trade with each other. A dealer is a financial intermediary that stands ready to buy or sell currencies at any time with its clients.

The interdealer market is also known as the “interbank” market due to the dominance of banks as Forex dealers.

The interdealer market is only accessible to institutions that trade in large quantities and have a very high net worth.

This includes banks, insurance companies, pension funds, large corporations, and other large financial institutions manage the risks associated with fluctuations in currency rates.

In the spot FX market, an institutional trader is buying and selling an agreement or contract to make or take delivery of a currency.

A spot FX transaction is a bilateral (“between two parties”) agreement to physically exchange one currency against another currency.

This agreement is a contract. This means this spot contract is a binding obligation to buy or sell a certain amount of foreign currency at a price that is the “spot exchange rate” or the current exchange rate.

So if you buy EUR/USD on the spot market, you are trading a contract that specifies that you will receive a specific amount of euros in exchange for U.S dollars at an agreed-upon price (or exchange rate).

Its important to mention out that you are NOT trading the underlying currencies themselves, but a contract involving the underlying currencies.

Even though its called “spot”, the transaction is not fully settle “on the spot”.

In reality, while a spot FX trade is done at the current market rate, the actual transaction is not settled until two business days after the trade date.

This is known as T+2 (“Today plus 2 business days”).

It means that delivery of what you buy or sell should be complete within two working days and is referred to as the value date or delivery date.

For example, an institution buys EUR/USD in the spot FX market.

The trade opened and closed on Monday has a value date on Wednesday. This means that itll receive euros on Wednesday.

Not all currencies settle T+2 though. For example, USD/CAD, USD/TRY, USD/RUB and USD/PHP value date is T+1, meaning one business day going forward from today (T).

Trading in the actual spot forex market is NOT where retail traders trade though.

Retail Forex

There is a secondary OTC market that provides a way for retail (“poorer”) traders to participate in the forex market.

Access is granted by so-called “forex trading providers”.

Forex trading providers trade in the primary OTC market on your behalf. They find the best available prices and then add a “markup” before displaying the prices on their trading platforms.

This is similar to how a retail store buys inventory from a wholesale market, adds a markup, and shows a “retail” price to their customers.

Forex trading providers are also known as “forex brokers”. Technically, they are not brokers because a broker is supposed to simply act as a middleman between a buyer and a seller (“between two parties”). But this is not the case, because a forex trading provider acts as your counterparty. This means if you are the buyer, it acts as the seller. And if you are the seller, it acts as the buyer. To keep things simple for now, we will still use the term “forex broker” since that‘s what most people are familiar with but it’s important to know the difference.

Although a spot forex contract normally requires delivery of currency within two days, in practice, nobody takes delivery of any currency in forex trading.

The position is “rolled” forward on the delivery date.

Especially in the retail forex market.

Remember, you are actually trading a contract to deliver the underlying currency, rather than the currency itself.

It‘s not just a contract, it’s a leveraged contract.

Retail forex traders cant “take or make delivery” on leveraged spot forex contracts.

Leverage allows you to control large amounts of currency for a very small amount.

Retail forex brokers let you trade with leverage which is why you can open positions valued at 50 times the amount of the initial required margin.

So with $2,000, you can open a EUR/USD trade valued at $100,000.

Imagine if you went short EUR/USD and had to deliver $100,000 worth of euros!

You‘d be unable to settle the contract in cash since you only have $2,000 in your account. You wouldn’t have enough funds to cover the transaction!

So you either have to close the trade before it settles or “roll” it over.

To avoid this hassle of physical delivery, retail forex brokers automatically “roll” client positions.

When a spot forex transaction is not physically delivered but just indefinitely rolled forward until the trade is closed, it is known as a “rolling spot forex transaction” or “rolling spot FX contract”. In the U.S., the CFTC calls it a “retail forex transaction”.

This is how you avoid being forced to accept (or deliver) 100,000 euros.

Retail forex transactions are closed out by entering into an equal but opposite transaction with your forex broker.

For example, if you bought British pounds with U.S. dollars, you would close out the trade by selling British pounds for U.S. dollars.

This is also called offsetting or liquidating a transaction.

If you have a position left open at the close of the business day, it will be automatically rolled over to the next value date to avoid the delivery of the currency.

Your retail forex broker will automatically keep on rolling over your spot contract for you indefinitely until it is closed.

The procedure of rolling the currency pair over is known as Tomorrow-Next or “Tom-Next”, which stands for “Tomorrow and the next day.”

When positions are rolled over, this results in either interest being paid or earned by the trader.

These charges are known as a swap fee or rollover fee. Your forex broker calculates the fee for you and will either debit or credit your account balance.

Retail forex trading is considered speculative. This means traders are trying to “speculate” or make bets on (and profit from) the movement of exchange rates. Theyre not looking to take physical possession of the currencies they buy or deliver the currencies they sell.

Forex Spread Bet

Spread betting is a derivative product, which means you dont take ownership of the underlying asset but speculate on whichever direction you think its price will move up or down

A forex spread bet enables you to speculate on the future price direction of a currency pair.

A currency pair‘s price being used on the spread bet is “derived” from the currency pair’s price on the spot FX market.

Your profit or loss is dictated by how far the market moves in your favor before you close your position and how much money you have bet per “point” of price movement.

Spread betting on forex is provided by “spread betting providers”.

Unfortunately, if you live in the U.S., spread betting is considered illegal. Despite being regulated by the FSA in the U.K., the U.S. considers spread betting to be internet gambling which is currently forbidden.

Forex CFD

A contract for difference (“CFD”) is a financial derivative. Derivative products track the market price of an underlying asset so that traders can speculate on whether the price will rise or fall.

The price of a CFD is “derived” from the underlying assets price.

A CFD is a contract, typically between a CFD provider and a trader, where one party agrees to pay the other the difference in the value of a security, between the opening and closing of the trade.

In other words, a CFD is basically a bet on a particular asset going up or down in value, with the CFD provider and you agree that whoever wins the bet will pay the other the difference between the assets price when you enter the trade and its price when you exit the trade.

A forex CFD is an agreement (“contract”) to exchange the difference in the price of a currency pair from when you open your position versus when you close it.

A currency pair‘s CFD price is “derived” from the currency pair’s price on the spot FX market. (Or at least it should be. If not, what is the CFD provider basing its price on?

Trading forex CFDs gives you the opportunity to trade a currency pair in both directions. You can take both long and short positions.

If the price moves in your chosen direction, you would make a profit, and if it moves against you, you would make a loss.

In the EU and UK, regulators decided that “rolling spot FX contracts” are different from the traditional spot FX contract.

The main reason being is that with rolling spot FX contracts, there is no intention to ever take actual physical delivery (“take ownership”) of a currency, its purpose is to simply speculate on the price movement in the underlying currency.

The objective of trading a rolling spot FX contract is to gain exposure to price fluctuations related to the underlying currency pair without actually owning it.

So to make this differentiation clear, a rolling spot FX contract is ruled as a CFD. (In the U.S., CFDs are illegal so its known as a “retail forex transaction”)

Forex CFD trading is provided by “CFD providers”.

Outside the U.S., retail forex trading is usually done with CFDs or spread bets.

-

DOLLAR EASES AS POWELL BUMP FADES

Abstract:On Tuesday, the yen dropped below the critical 120 level for the first time since 2016, after Federal Reserve Chair Jerome Powell’s hawkish speech increased bets on rising US interest rates and widened the policy gap with a dovish Bank of Japan.

- On Tuesday, the yen dropped below the critical 120 level for the first time since 2016, after Federal Reserve Chair Jerome Powell’s hawkish speech increased bets on rising US interest rates and widened the policy gap with a dovish Bank of Japan.

- The dollar fell on Tuesday after rising the previous day, as comments from US Federal Reserve Chair Jerome Powell faded and stock markets rose, boosting risk-on mood.

On Monday, the dollar witnessed its greatest one-day percentage rise since March 10 as Powell hinted at hiking rates by more than 25 basis points at forthcoming policy meetings to battle inflation. wikifx According to CME’s FedWatch Tool, traders are pricing in a 66.1% likelihood of a 50 basis point raise at the Fed’s May meeting, up from slightly more than 50% a week earlier.

Following Powell’s remarks, Goldman Sachs now expects the Fed to increase interest rates by 50 points at its May and June meetings.

Investors were in a risk-on attitude as U.S. stocks gained, denting some of the greenback’s safe-haven appeal, with equities benefiting, in part, from bank shares on Fed rate rise forecasts.

“For the dollar, it is well supported by the Fed’s increasingly hawkish rate stance,” said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington, DC. “But it is off its peaks, risk appetite has something to do with that, with stocks higher that is kind of tempering the dollar’s gains.”

At least for the time being, it appears that the market is giving the Fed the benefit of the doubt that it can promote a gentle landing, which is supporting risk appetite and limiting dollar gains. The dollar index dropped 0.063%.

The yen’s recent depreciation continued as the Bank of Japan reiterated its commitment to maintaining its ultra-easy monetary policy.

The yen fell to a new six-year low of 121.03 per dollar and was last down 1.03%against the greenback at 120.70 per dollar.

The yen also fell against the other currencies, with the euro reaching a five-month peak of 133.33 and closing 1.18% higher at $133.14. The yen fell to a more than 6-1/2-year low versus the Swiss franc at 128.91, while the franc rose 1.48% to $128.89. The euro increased 0.14% to $1.1029. The euro has depreciated over the last month as the war in Ukraine has worsened, rising energy costs. On Monday, European Central Bank (ECB) President Christine Lagarde stated that the Fed and ECB will be out of sync due to the conflict in Ukraine’s differing effects on their respective economies.

On Tuesday, ECB policymaker Francois Villeroy de Galhau stated that the central bank must look beyond short-term fluctuations in energy costs and focus on underlying inflation trends.

The British pound was last trading at $1.3249, up 0.64% on the day.

Bitcoin yesterday increased 4.18% to $42,874.48 in cryptocurrencies.

Last night, Ethereum gained 3.63% to $3,015.46.

With ONSTON/USDT being the top gainer in cryptocurrency.

-

Segregated accounts and forex bonuses – Khwezi Trade has it all

Abstract:Segregated accounts and forex bonuses are designed to safeguard the financial interests of traders while allowing them to reap more. How is Khwezi Trade making this possible?

The financial markets nowadays feature hundreds, if not thousands, of forex brokers who are trying to attract more beginner traders by providing outrageous offers and benefits. wikifx Traders who have been trading for a while already have it ingrained into them that they should never deal with unregulated brokers.

The reason for this is extremely simple; unregulated brokers are not bound by law to ensure client fund security. In addition to this, these brokers are not overseen to ensure that they fulfil their financial obligations or provide a transparent, fair, and safe trading environment. The new over-the counter (OTC) regulation has been implemented by the local regulator, the FSCA, to combat bad players in the industry. Khwezi Trade, a division of Khwezi Financial Services (Pty) Ltd, is the first South African owned forex platform to be authorised and approved by the FSCA and has received the OTC licence. View a comprehensive list of FSCA Forex Brokers.

There are lists of blacklisted brokers that got away with client funds because of the false front that they put up, drawing in unsuspecting investors and traders of all experience levels. Unfortunately, these brokers have given deposit and trading bonuses a bad name, and because of this most traders associate the presence of bonuses with the signs that they may be dealing with a scam broker.

However, this is not always true and there are still brokers that can offer bonuses while ensuring that client funds are kept safe in segregated accounts which are separate from the brokers funds.

What is client segregation of funds?

A segregated account is a separate account for each trader. Funding your trading account with a broker that offers segregated bank accounts has several advantages. Primarily, the separate account provides traders with a measure of protection if their brokerage goes out of business.

Neither the brokerage nor the trader is left in the dark as to where their money is going or how it is being utilized. A segregated account is required by many countries to guarantee that customer money is not utilized for operational reasons by brokerages. Confusion is avoided, and both parties are protected by using a separate account.

Only brokers with a category 2 Financial Advisory and Intermediary Services (FAIS) licence can offer segregated third-party funds administration accounts (TPFA) to their clients. These TPFA accounts are held with a top-tier South African bank.

What are Deposit bonuses and what purpose do they serve?

When it comes to attracting new clients, the deposit bonus is one of the most popular promotional incentives. Traders get a set sum of money or a percentage of their original investment in return for funding their trading accounts. This is the basic principle.

Most of the time, new customers are only eligible for this sort of promotion. Some Forex deposit bonus brokers, however, give this advantage to their consumers whenever they deposit to their trading account.

How the Khwezi Trade offer makes it stand out from the rest

Khwezi Trade is a proudly South African Forex commodity and indices broker that offers traders the best of both worlds; a guarantee that their funds are safeguarded and kept in segregated accounts, and the reward that they will receive a 30% deposit bonus on their first deposit.

Khwezi Trade is regulated and overseen by the Financial Sector Conduct Authority (FSCA) in South Africa, with the registration number FSP 44816. The FSCA is one of the strictest market regulators in the world and to keep their license, Khwezi Trade is required to ensure that all funds are kept in accounts with top-tier banks in South Africa.

-

Forex Market Size And Liquidity

Abstract:Unlike other financial markets like the New York Stock Exchange (NYSE) or London Stock Exchange (LSE), the forex market has neither a physical location wikifx nor a central exchange.

The bulk of forex trading takes place on whats called the “interbank market”.

Unlike other financial markets like the New York Stock Exchange (NYSE) or London Stock Exchange (LSE), the forex market has neither a physical location nor a central exchange.

The forex market is considered an over-the-counter (OTC) market due to the fact that the entire market is run electronically, within a network of banks, continuously over a 24-hour period.

This means that the FX market is spread all over the globe with no central location.

Trades can take place anywhere as long as you have an Internet connection!

The forex OTC market is by far the biggest and most popular financial market in the world.

And it is traded globally by a large number of individuals and organizations.

In an OTC market, participants can be picky and determine who they want to trade with depending on trading conditions, the attractiveness of prices, and the reputation of the trading counterparty (the other party who takes the opposite side of your trade).

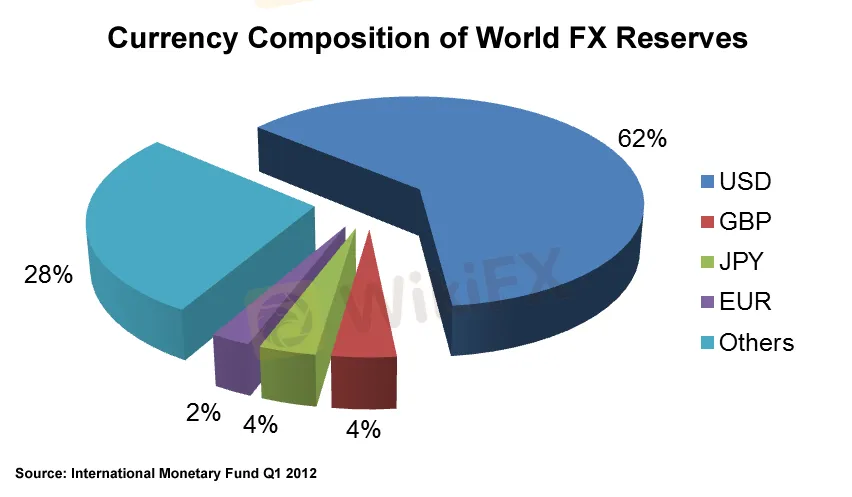

The chart below shows the seven most actively traded currencies.

*Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100%

The U.S. dollar is the most traded currency, making up 84.9% of all transactions!

The euros share is second at 39.1%, while that of the yen is third at 19.0%.

As you can see, most of the major currencies are hogging the top spots on this list!

The Dollar is King in the Forex Market

Youve probably noticed how often we keep mentioning the U.S. dollar (USD).

If the USD is one-half of every major currency pair, and the majors comprise 75% of all trades, then its a must to pay attention to the U.S. dollar. The USD is king!

In fact, according to the International Monetary Fund (IMF), the U.S. dollar comprises roughly 62% of the worlds official foreign exchange reserves!

Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies.

Because almost every investor, business, and central bank own it, they pay attention to the U.S. dollar.

There are also other significant reasons why the U.S. dollar plays a central role in the forex market:

· The United States economy is the LARGEST economy in the world.

· The U.S. dollar is the reserve currency of the world.

· The United States has the largest and most liquid financial markets in the world.

· The United States has a stable political system.

· The United States is the worlds sole military superpower.

· The U.S. dollar is the medium of exchange for many cross-border transactions. For example, oil is priced in U.S. dollars. Also called “petrodollars.” So if Mexico wants to buy oil from Saudi Arabia, it can only be bought with the U.S. dollar. If Mexico doesnt have any dollars, it has to sell its pesos first and buy U.S. dollars.

Speculation in the Forex Market

One important thing to note about the forex market is that while commercial and financial transactions are part of the trading volume, most currency trading is based on speculation.

In other words, most of the trading volume comes from traders that buy and sell based on the short-term price movements of currency pairs.

The trading volume brought about by speculators is estimated to be more than 90%!

The scale of the forex market means that liquidity – the amount of buying and selling volume happening at any given time – is extremely high.

This makes it very easy for anyone to buy and sell currencies.

From the perspective of a trader, liquidity is very important because it determines how easily price can change over a given time period.

A liquid market environment like forex enables huge trading volumes to happen with very little effect on the price, or price action.

While the forex market is relatively very liquid, the market depth could change depending on the currency pair and time of day.

In our forex trading sessions part of the School, we‘ll explain how the time of your trades can affect the pair you’re trading.

In the meantime, lets learn about the different ways that individuals can trade currencies.

-

WikiFX Great Update – Comparison 1 – 5 Forex Brokers by One Single Click

Abstract:WikiFX is the best platform that helps traders with full details and information of over 32,000 brokers for free. WikiFX has implemented a well comparison section in which users can compare from 1 to 5 brokers at the same time free of charge. Before we go further a word compare in terms of forex trading, means to examine or to know the similarities of two or more brokers.

Hi our valuable users, we want to inform you that we have a latest update on WikiFX website, and it will soon be implemented on the application for easy use.

https://www.youtube.com/watch?v=3LK-rgPwBKU WikiFX is the best platform that helps traders with full details and information of over 32,000 brokers for free. WikiFX also helps forex victims who are scammed by brokers. With WikiFX, you will get chance to recover your money if you have your full transaction evidence.

WikiFX has implemented a well comparison section in which users can compare from 1 to 5 brokers at the same time free of charge. Before we go further a word compare in terms of forex trading, means to examine or to know the similarities of two or more brokers.

With brokers comparison, it’s very easy for traders to know

- Rating of the broker

- Trading fee

- Account feature

- Trading platform

- Deposit and withdrawal

- Regulatory updates

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.